Immigration Services

Garant Business Consultancy specialises in immigration services for non-EU citizens to Cyprus. We maintain excellent working relationships with government authorities as well as real estate companies to facilitate immigration processes.

We can assist in the application process for the following:

- Cyprus Investment Program

- Permanent Residency

- Other permits

Cyprus Investment Program

Foreign investors may apply for Cyprus citizenship by investing in the economy of the country.

Key benefits

- Freedom to travel, reside and work within the European Union (EU).

- Family members can also subsequently obtain Cypriot Citizenship (married spouse, children up to 18 years old and financially dependent children up to 25 years old).

- Freedom to transfer any amount of money between EU Member States, purchase property in EU, make any investments in the EU.

- Freedom to transfer goods produced in the EU between EU Member States.

- There is no requirement to physically reside in Cyprus before or after obtaining Citizenship.

Key criteria

- Investment through any of the below schemes A1 - A4

- Purchase of privately-owned property of minimum €500,000 + VAT

- Clean Criminal Record

- Donation of €75,000 to the Foundation for Research and Innovation to promote the creation of an entrepreneurial innovation ecosystem, an obligation that can be waived under certain conditions.

- Donation of €75,000 to the Cyprus Land Development Corporation, aiming at the contribution to the integrated housing policy, specifically for the purpose of implementing affordable housing projects and the implementation of other housing plans/measures.

- The investment should be maintained for 5 years following the date of naturalisation.

- he applicant must maintain a residential property of at least €500,000 following the 5 years.

- During the 5-year period, the investor will be able to change his investment, provided that consent will be granted in this regard by the Ministry of Finance.

- The applicant must have a Schengen visa in order to be able to apply for naturalization.

- An applicant who has applied for the acquisition of citizenship in any other Member State of the European Union and has been rejected will not be entitled to acquire Cypriot citizenship within the framework of the Cyprus Investment Program.

Investments

A1. Real estate and land developing

- A direct investment in Cyprus of at least €2,0 million for the acquisition or development of real estate projects (residential, commercial, tourism or other infrastructure).

- Investment in land under development is included in this criterion, provided that an investment plan for the development of the purchased land will be included in the application.

A2. Purchase or participation in Cypriot businesses or companies

- An investment of at least €2,0 million in the purchase, or participation in businesses or companies, that are based and operating in Cyprus.

- Businesses or companies must have a tangible presence and substantial economic activity in Cyprus.

- Businesses or companies must employ at least 5 Cypriot or EU citizens who have been legally residing in Cyprus for a continuous period of at least 5 years.

A3. Investment in AIFs, financial assets of Cypriot businesses or organisations which are licensed by the Cyprus Securities and Exchange Commission (CySec)

- Purchase of financial assets of at least €2,0 million (units in AIFs, bonds, debentures, other securities, etc) registered and issued in the Republic of Cyprus, in companies or organisations with substantial economic activity in Cyprus, regulated by CySec.

A4. Combination of the aforementioned criteria

- The applicant may choose to have a combination of any of the above criteria amounting to at least €2,0 million.

Permanent Residency

Permanent residency may be obtained by non-EU nationals without the need to engage in any business, trade or profession on the island.

Key benefits include:

- Holders are exempted from having to obtain a Visitor's Visa when entering the country.

- Family members can also subsequently obtain permanent residency (married spouse, children up to 18 years old and financially dependent children up to 25 years old).

- Permit is granted for an indefinite period of time.

Key criteria

- €30,000 3-year fixed deposit at any Cyprus bank transferred from abroad

- Purchase of dwelling or other building of at least €300,000 + VAT

- Secure annual income of €30,000

- Amount increased by €5,000 for every dependent person

- Clean Criminal Record

An immigration permit may also be granted to children of the applicant between the age of 18 - 25, who are unmarried and financially dependent on the applicant. Children over 18, who are not financially dependent on the applicant, can get the immigration permit provided that the market value of the acquired property attributed to each such child is at least €300.000, excl. VAT.

Other permits

Assistance in the application process for the following permits can also be provided:

- Temporary Residence ("Pink Slip") – Visitor Visa

- Temporary Residence ("Pink Slip") – Employment Visa

- Immigration permit

- Residence permit

Tax Resiency - 60 DAY RULE

According to Cyprus tax legislation, an individual who spends more than 60 days in Cyprus can be considered as tax resident in Cyprus, provided that he/she meets cumulatively certain conditions.

Benefites

- PExemption from taxation of dividends and interest earned for a period of 17 years after becoming Cyprus tax resident.

- PProfit arising from the sale of securities that include shares, bonds, deben tures and others is exempted from taxation in Cyprus.

- P50% of the salary of individuals earning in excess of €100,000 annually are exempt from tax for a period of 10 years.

- PEmployment income from salaried services rndered outside Cyprus for more than 90 days in a tax year to a non Cyprus resident employer is exempt from Cyprus tax.

Criteria

- Spend cumulatively more than 60 days in Cyprus during a calendar year.

- Do not spend more than a total of 183 days in any country within a tax year.

- Not a tax resident of another country within the same tax year.

- Employed in Cyprus or Director in a company resident in Cyprus at any time during the tax year.

- Maintain a permanent residence in Cyprus, which can be either owned or rented.

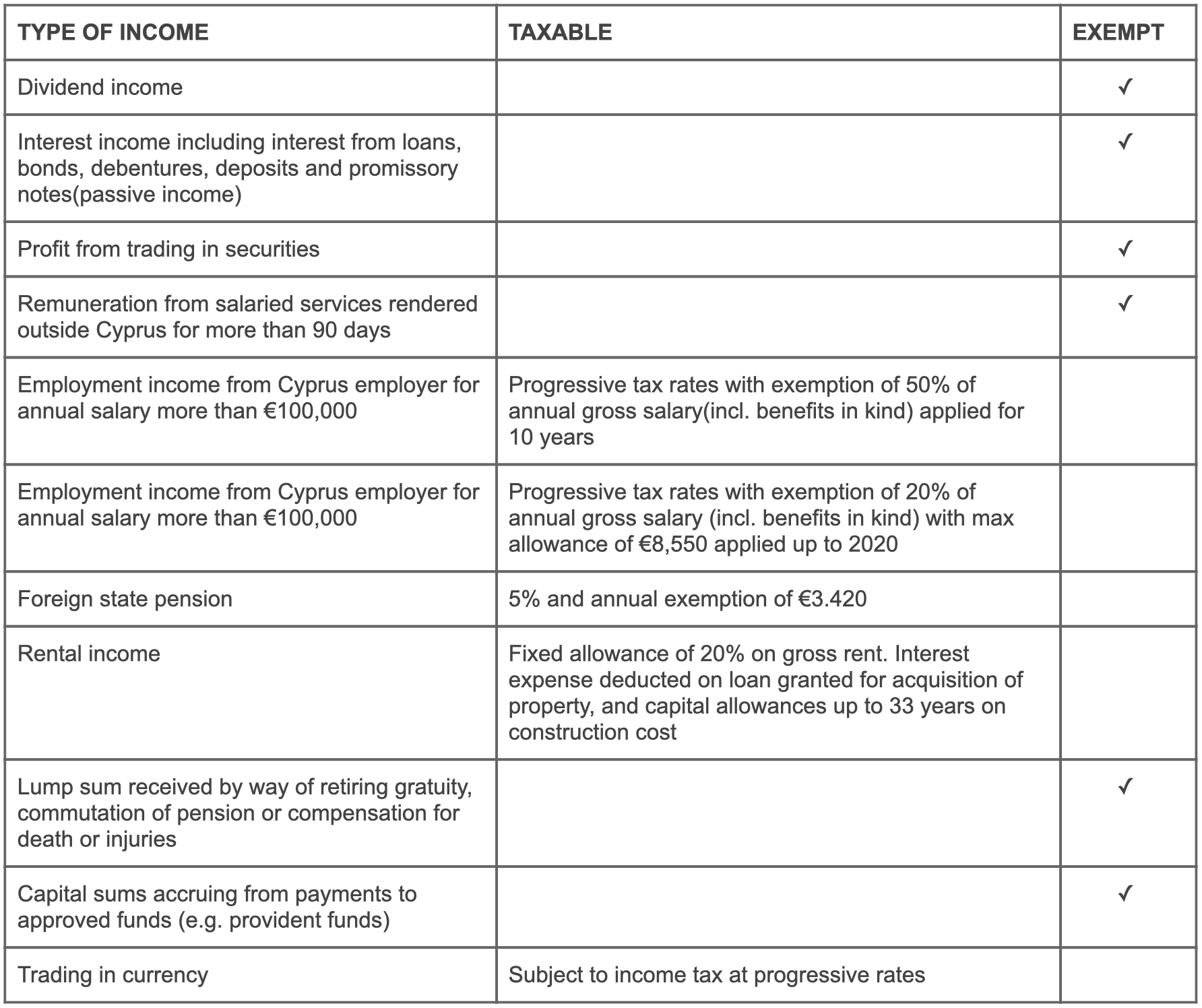

Tax Treatment of Income

Contributions relating to the implementation of the National Health System (NHS) start from 1 March 2019, and will increase from 1 March 2020.

Read more:

- Updates on Golden visa in the UAE