Everything You Need to Know About Opening a Bank Account in the UAE for a New Company

Therefore, structuring your business properly is crucial for future interactions with financial institutions. This includes:

- Choosing the optimal jurisdiction for company registration

- Defining the type of activity listed on the business license

- Structuring the company's ownership

Let’s go over some factors that may lead to a more complicated and lengthy process when opening a business account.

The more layers of ownership a company has, the more checks the bank will need to conduct to analyze the business and establish the UBO (Ultimate Beneficial Owner). Complex ownership structures can raise red flags and delay the process as banks work to identify the true owners of the business.).

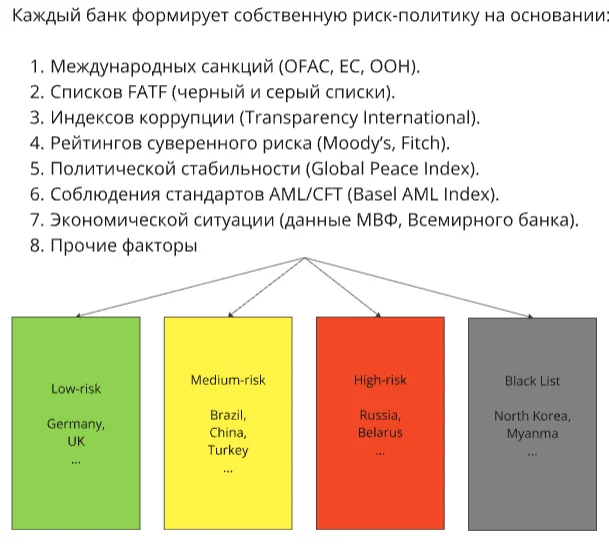

The nationality of company owners is often an indicator of risk:

- Low-risk countries (e.g., EU countries) are generally associated with transparent operations and reliable sources of funds.

- High-risk countries (e.g., North Korea, Iran) are more likely to face stricter due diligence procedures, or even account opening denials, due to concerns over money laundering and terrorism financing.

In addition to prohibited activities, such as gambling and arms trading, banks maintain a list of high-risk business activities that require more thorough checks due to their potential links to money laundering (ML) or financing terrorism (FT).

The activities listed on your license should reflect the actual business operations. Avoid including a wide range of unrelated business activities in a single license, especially if they are not part of your immediate business plan.

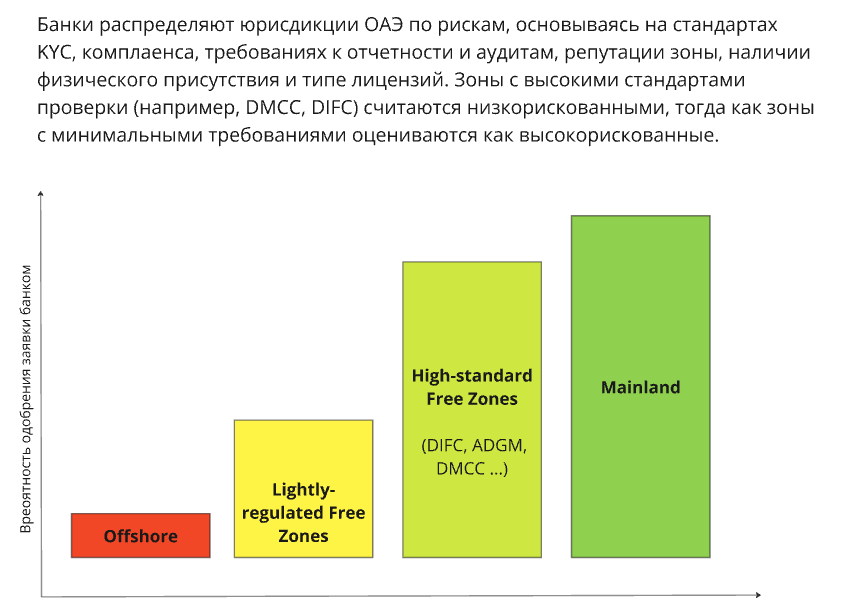

Banks are generally wary of offshore zones, as these can be used to create complex corporate structures that make it difficult to trace the source of funding or identify the actual owners. Furthermore, banks have varying attitudes toward UAE Free Zones. This is something to consider if there is a high risk of account rejection.

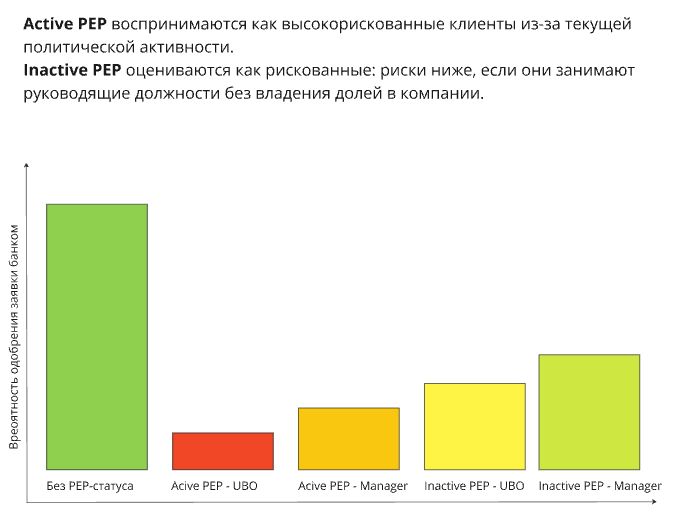

If a client or their close relatives have held important public or political positions, they may be classified as Politically Exposed Persons (PEP). This status is linked to a higher risk of money laundering and corruption. According to the FATF (Financial Action Task Force) recommendations, banks must perform thorough due diligence on PEPs.

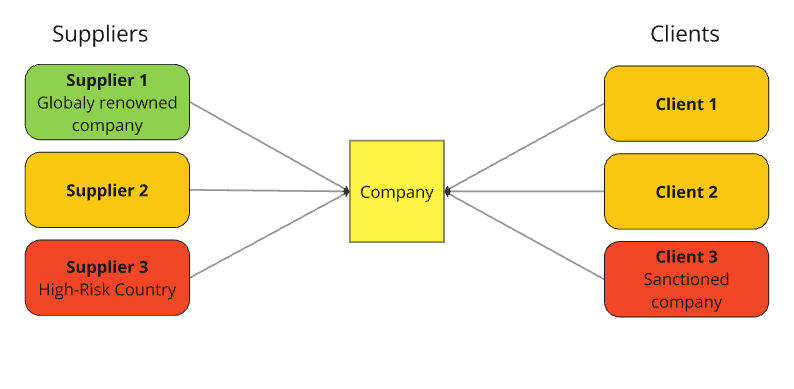

At the account opening stage, banks typically request information about current and potential buyers and suppliers to ensure they are not engaging with individuals or companies from countries that violate international money laundering and terrorism financing standards. This helps mitigate risks associated with illicit transactions.

1. Build Trust and Transparency with the Bank Establish transparent, trustworthy relationships with your bank and ensure you prepare all necessary documents for due diligence checks.

2. Keep the Ownership Structure Simple If you are opening an account for a new business in the UAE, avoid complicating the ownership structure unnecessarily or including too many unrelated activities in the license. Start with a simple and clear case. You can always modify your license later as needed. While the bank may perform a re-check, a business with a transparent structure and clear operational patterns is much more likely to succeed in the process.

3. Consider Alternative Solutions If you encounter difficulties opening an account with local UAE banks, consider opening a non-resident account in banks from other jurisdictions, or through companies licensed as Electronic Money Institutions (EMI). While this might not be the most convenient or cost-effective option, it can allow you to start operations. Later, you can apply for a UAE bank account using an existing account statement, which will greatly simplify the onboarding process. This way, the bank can review actual business operations, such as transaction types, volumes, and counterparties.

In conclusion, by carefully structuring your business, being transparent with financial institutions, and following these recommendations, you can increase your chances of successfully opening a business bank account in the UAE.

Is it necessary to maintain a balance when opening an account?

In practice, the requirement for maintaining a balance and its amount depends on the company’s risk profile. Banks try to balance the risks and effort involved in managing a client with the potential profitability. Most commonly, the discussed balances range from 100,000 to 500,000 AED. If your business model doesn't allow for maintaining such balances, we recommend considering neobanks or Electronic Money Institutions (EMIs).

Can a non-resident company open an account in the UAE?

In practice, opening an account for a non-resident company is only feasible for relatively large businesses. If you're interested in opening a bank account in the UAE, we recommend registering a company or a branch within the country.

Can an offshore company open an account in the UAE?

Local banks are generally reluctant to consider offshore zones, as they can be used to create complex corporate structures that make it difficult to track the sources of funding and identify real owners. We recommend looking into EMIs or banks in other jurisdictions.

Is remote account opening possible?

Opening a corporate account with UAE banks usually requires the presence of the account signatory for identification purposes (in most cases). Some digital banks require an in-person meeting with a courier after account approval to receive a corporate card; without this, the account will not be activated. If you're specifically interested in remote account opening, it's best to consider EMIs.

Is it possible for a legal entity to obtain a loan?

Typically, when applying for credit products, the bank will ask for audited financial statements for the past three years.

What documents are required to open an account?

The basic document package required for opening a corporate account includes:

1. Passports of the owners/CEO

2. Emirates ID of the owners/CEO

3. Visas of the owners/CEO

4. CV

5. Proof of residence address of the CEO

6. Company incorporation documents

7. Company website

8. Company profile description, including business activities, product or service descriptions, suppliers, clients, and a financial forecast for the next 2 years

9. Office lease agreement

10. Bank statement (personal or company) for the past 6 months

11. Supporting documents for 3 debit and 3 credit transactions from the company account

12. Copies of signed contracts or drafts of future contracts

Which banks do you work with?

We work with most banks in the UAE (e.g., ADIB, ADCB, CBD, EIB, ENBD, Zand, Misr, and others), banks outside the UAE (e.g., Adriatic, Bank One, MTI, and others), and EMIs (e.g., 3S Money, Multipass, Emerald, and others).

+971-56-981-35-89

linkedin.com/in/nikita-afanasev-fin/