Venture Capital structure in the UAE

Publications Written by Marsel Shadmanov

Thus, the national efforts throughout the Gulf Cooperation Council (GCC) region, particularly in the United Arab Emirates (UAE), use VC as one more tool to maximize foreign investments. Mechanisms of VC structuring are not as complex, as it might be deemed from the first glance. It can be implemented in both onshore, and offshore jurisdictions.

There is an acknowledgement in the country that small and medium-sized businesses (SMEs) are eager to expand their operations to other Middle Eastern nations by leveraging VC funding. Being a developing segment, the term "venture capital" implies traditional VC funding, angel investments, private equity, crowdfunding, funding from strategic investors, personal finance, and financing from banks. In this article, we would like to outline the key principles in the formation of a VC structure, which type of agreement is prevalent in the UAE.

Special Purpose Vehicle

As a tool of structuring, Special Purpose Vehicle (SPV) is a classic approach to form a VC. SPV is a business entity with a special limited purpose, as a rule it is an operating vehicle or funding vehicle. In the venture capital business, SPVs are used to pool money from a group of investors to make a single investment in a startup. SPVs are often created to protect the assets and share the liabilities of a parent or subsidiary company. Each SPV, which may have the same managing and sponsoring organization ("SPV Arranger"), has its own operating structure, ownership structure, balance sheet and is financially independent of any other SPV with the same SPV Arranger.

Although an SPV can be any form of ownership, it is usually either a Limited Liability Company (LLC) or a Limited Partnership (LP). The SPV, for instance, is present in such jurisdictions, as ADGM in Abu Dhabi, and DIFC and RAKICC in Dubai with their own status. DIFC and ADGM SPVs have traditionally been used to hold significant investments, such as real estate, and to raise investment funds. Most often, ADGM SPVs are used by foreign investors to hold their interests in mainland companies to take advantage of a regulatory framework that facilitates the efficient formation of trusts. RAKICC SPVs have an offshore company status, while ADGM and DIFC are onshore. Thus, the RAKICC SPV gives a number of advantages in terms of tax optimization, compared to the onshore jurisdictions.

Formation of VC in Dubai

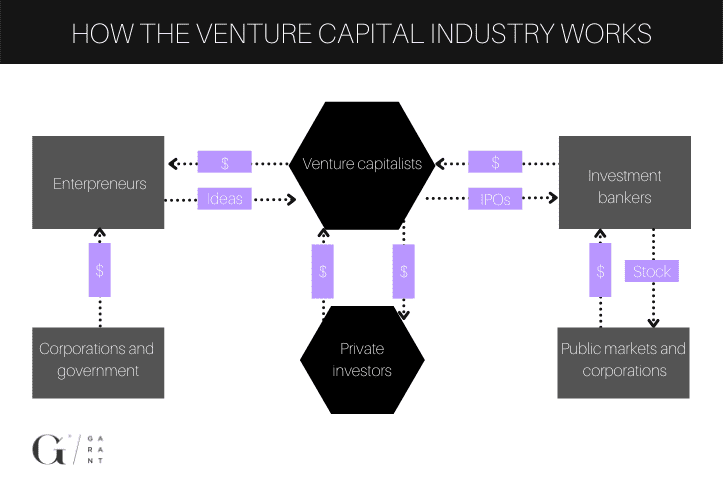

Individuals, companies, and investment banks can all be VC investors. Sovereign wealth funds, which are state agencies, select to invest in various local and regional start-ups in GCC countries.

When it comes to offshore venture capital funds, due to a fast process backed by regulations, several UAE free zones offer a wide range of fund structures. The Freezones provide start-up financing, training and/or strategic advice to entrepreneurs in the TMT sector. Financing from these government authorities most often is facilitated in a form of business incubation and hosting investment events. In addition, UAE free zones provide entrepreneurs with financing, training and strategic advice. The formation of venture capital funds in the UAE offer tax incentive schemes, including a tax-free venture capital fund.

The process of formation of the VC is relatively straightforward from a legal perspective. The SPV can be structured on a clear-cut basis, consisting of 20-30 potential investors during the first round of fundraising, who will sign the convertible loan agreement (CLA). The purpose of such an agreement lies within the snag, which is concealed within the basic Investment Agreement. For instance, basic Investment Agreement will consider only the key outlines, such as the amount of investments, the period, and percentage rate, which the sponsored company is obliged to retrieve, however, from the legal point of view, it is challenging to enforce such agreement. Therefore, a professional investor is not likely to accept such terms and conditions.

CLA, on the other hand, is a more sophisticated version of the Investment Agreement, which considers additional terms, such as conversion of liabilities into the equivalent assets, such as company shares of, for instance, a holding company. There are several classes of shares, which are transferred to a particular investor in order to differentiate fields of rights for specific share class. This, in turn, preserves the control over a company, and also helps to protect the first-priority payout to investors. Thus, the number of shares, coequal to the amount of the investment, is defined in CLA. For such an advancement, this type of agreement is considered the most common agreement between the investor and the investee that collectively form a VC. Moreover, there is a term, called maturity date, which determines which date is allowed for conversion of investments into company shares, restricting the acquisition of shares before this date. The period of maturity might be 1, 2 years, depending on each specific CLA.

The figure below represents the structure of the VC in the UAE:

Normally, venture capital funds in the UAE focus on a specific industry, although there are a number of funds with broad investment objectives. There is a non-regulated light structure, which allows a first round, while there are more sophisticated schemes, which are implemented in a form of funds, with a capital, being regulated by financial regulatory authority, which, in turn, are regulated by the manager. Such Venture capital funds typically have a term of eight to ten years, with possible extensions at the discretion of the investment manager which serves to align the investment term with the expected liquidity events of the underlying investments. Investors in venture capital funds in the UAE negotiate a "hurdle rate" or preferred return of 5% to 10% and expect returns of 10% to 20%.

Shareholder Agreement

As a result, the participants of VC tend to hold different classes of assets and liabilities. Therefore, in order to avoid the discrepancies between investors, there is an internal agreement signed to regulate the relations between all participants, called Shareholder Agreement (SHA). Normally, it stated that there is a certain number of investors, holding A, or B class of shares, where shares A might regulate the preference shares, whereas shares B might imply non-voting shares.

If you would like advice or assistance concerning the consultations for opening or joining VC in the UAE, kindly contact us.

Marsel Shadmanov

Head of Corporate Services at Garant Business Consultancy DMCC

Phone +971 4 421 4335

Email info@garant.ae