How to Build an Effective HR Policy for International Business: Practical Advice for HR Managers and Executives

International business requires a flexible and well-thought-out HR policy.

Companies operating in multiple countries face differences in labor laws, taxation, and corporate culture. This is especially true for businesses working between European, CIS countries and the UAE, where HR strategies must account for completely different legal frameworks, tax systems, and approaches to personnel management.

A poorly structured HR policy can lead to legal risks, tax penalties, and difficulties in hiring key employees. How can this be avoided? Let’s break it down.

Start with a unified HR strategy adapted to local specifics

The most common mistake in scaling is trying to "copy-paste" an HR model from one country to another without considering local nuances. An international HR strategy should be unified in goals and values, but flexible in execution.

The UAE, CIS, Europe, and the US have significant cultural differences: communication styles, employee expectations, and principles of loyalty to the employer.

Approaches to motivation also differ: in the UAE, performance-based bonuses, flexible hours, and housing allowances are common; in Russia — stable salaries and extended social benefits;

for Europeans — a decent salary, guaranteed vacation (20–30 days), and strong social support systems are key;

in the US — bonuses, stock options, equity (especially in startups), and KPI systems dominate.

Another critical factor that must not be overlooked is local labor law.

For instance, under Federal Decree-Law No. 33 of 2021, the UAE regulates labor relations in the private sector: an employment contract must be in writing and registered with the UAE Ministry of Human Resources and Emiratisation (MOHRE).

Also, foreign workers must obtain a work visa sponsored by the employer to legally work in the UAE.

The process includes obtaining a work permit, entry visa, undergoing a medical exam, and receiving an Emirates ID.

If a company operates both in the UAE and any other country, it is important to establish effective collaboration between departments. This includes:

-Cross-training employees — knowledge sharing between teams in different countries

-Hybrid or remote teams — hiring staff with the option to work from various countries

-International rotations — employee exchange programs between offices

-Regular online meetings and strategic sessions

-Language and intercultural communication training

-Shared corporate events, even if online

Tax and Legal Aspects of Managing Personnel Across Borders

In February 2024, Russia and the UAE signed a protocol amending the Double Taxation Agreement (DTA).

This international treaty, originally in effect since 2011, is aimed at preventing the same income from being taxed in both countries.

The changes were driven by efforts to combat tax evasion and close loopholes that allowed companies and individuals to exploit tax benefits without conducting real business activity in either country.

This reflects the global trend of curbing aggressive tax planning, in line with OECD and BEPS initiatives.

For individuals and legal entities, this means:

-Lower overall tax burden

-Clearer tax residency rules

-More predictability in cross-border operations

-Legal protection from double taxation

The agreement is expected to come into force on January 1, 2026.

However, as of today, it’s crucial to consider that if an employee works remotely from Russia for a UAE-based company, they are personally responsible for paying taxes in Russia. If they relocate, their tax obligations may change.

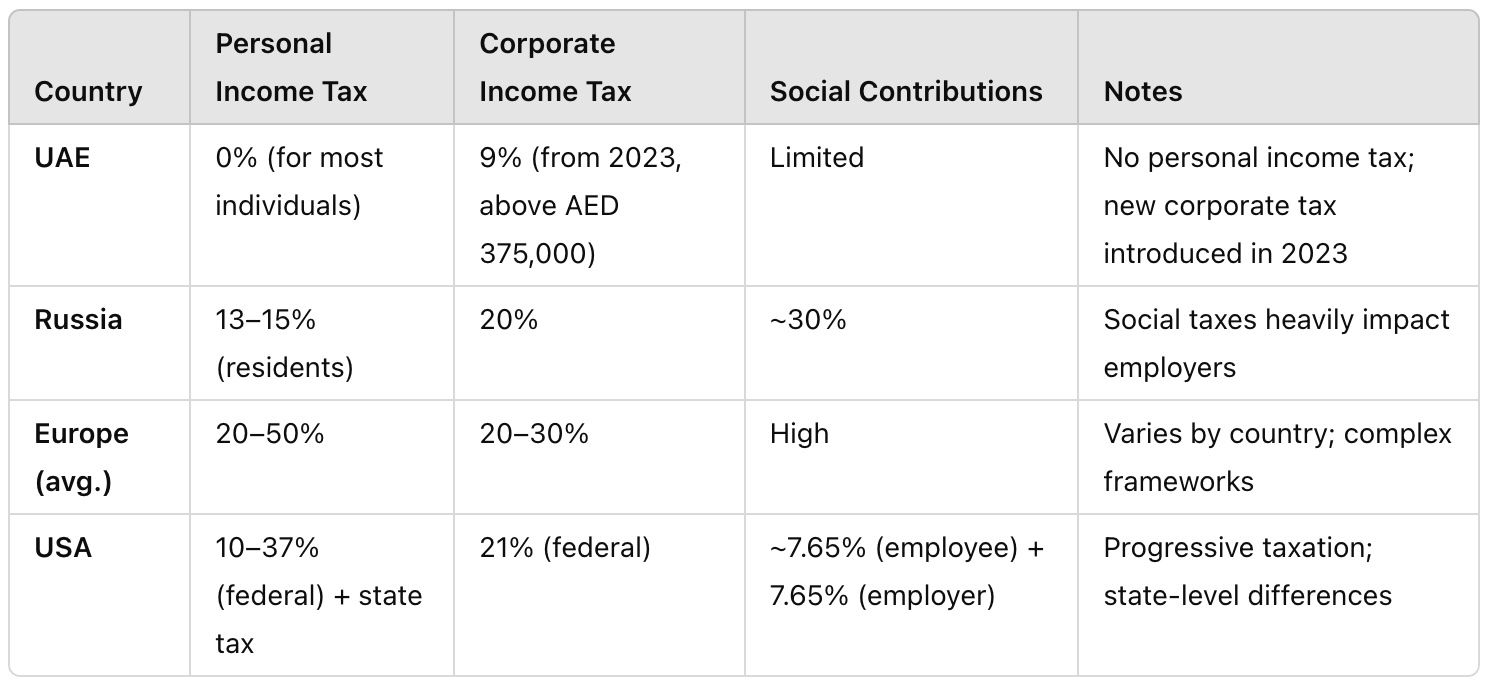

Key Differences in Tax Systems of the UAE, Russia, Europe, and the US (especially relevant to business and employment)

(Table provided earlier — here you can insert or reference it)

When choosing between local hiring, relocation, or external contracting, both strategic goals and risks should be considered:

- Local hiring helps adapt quickly to the market but requires establishing a legal entity in the country.

- Relocating employees can be justified when trusted personnel are needed, but involves visa, migration, and tax complexities.

- Outsourcing and EOR (Employer of Record) models are especially popular when entering a new jurisdiction. They allow you to hire employees without setting up a local company.

Leverage Technology: Automate Your HR Processes

To effectively manage international teams, it's especially important to:

-Use unified HRIS systems (Human Resource Information Systems) that consolidate data across all employees

-Implement systems for time tracking, bonus calculations, and monitoring OKRs/KPIs

-Integrate with finance and legal modules — especially for multicurrency payrolls

Other processes you can automate include:

-Managing taxes and insurance contributions

-Monitoring work hours and productivity

-Document management (contracts, visas, permits)

SAP, BambooHR, Deel — platforms that help manage HR operations in international companies.

Conclusion

Effective HR policy in international business requires a balance between corporate standards and local realities.

Failure to comply with local labor and tax regulations can lead to serious consequences — from fines and lawsuits to reputational damage.

That’s why it’s essential to constantly monitor legal changes and quickly adapt your company’s HR strategy to ensure both compliance and efficiency.

Planning to enter the international market?

Set up your HR strategy properly to keep your business running smoothly — without unnecessary issues and penalties.

Want expert advice? Get in touch.

Marcel Shadmanov